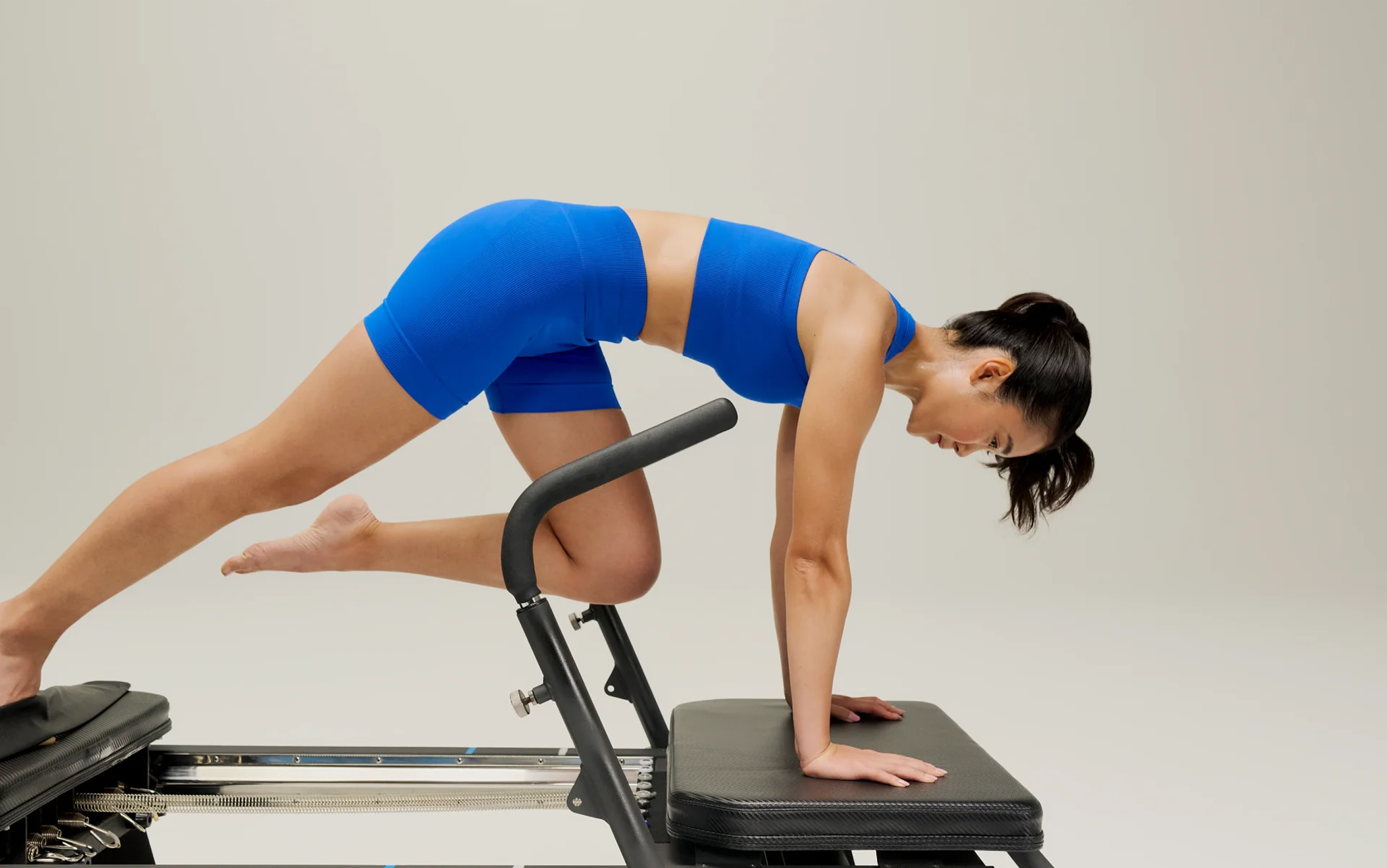

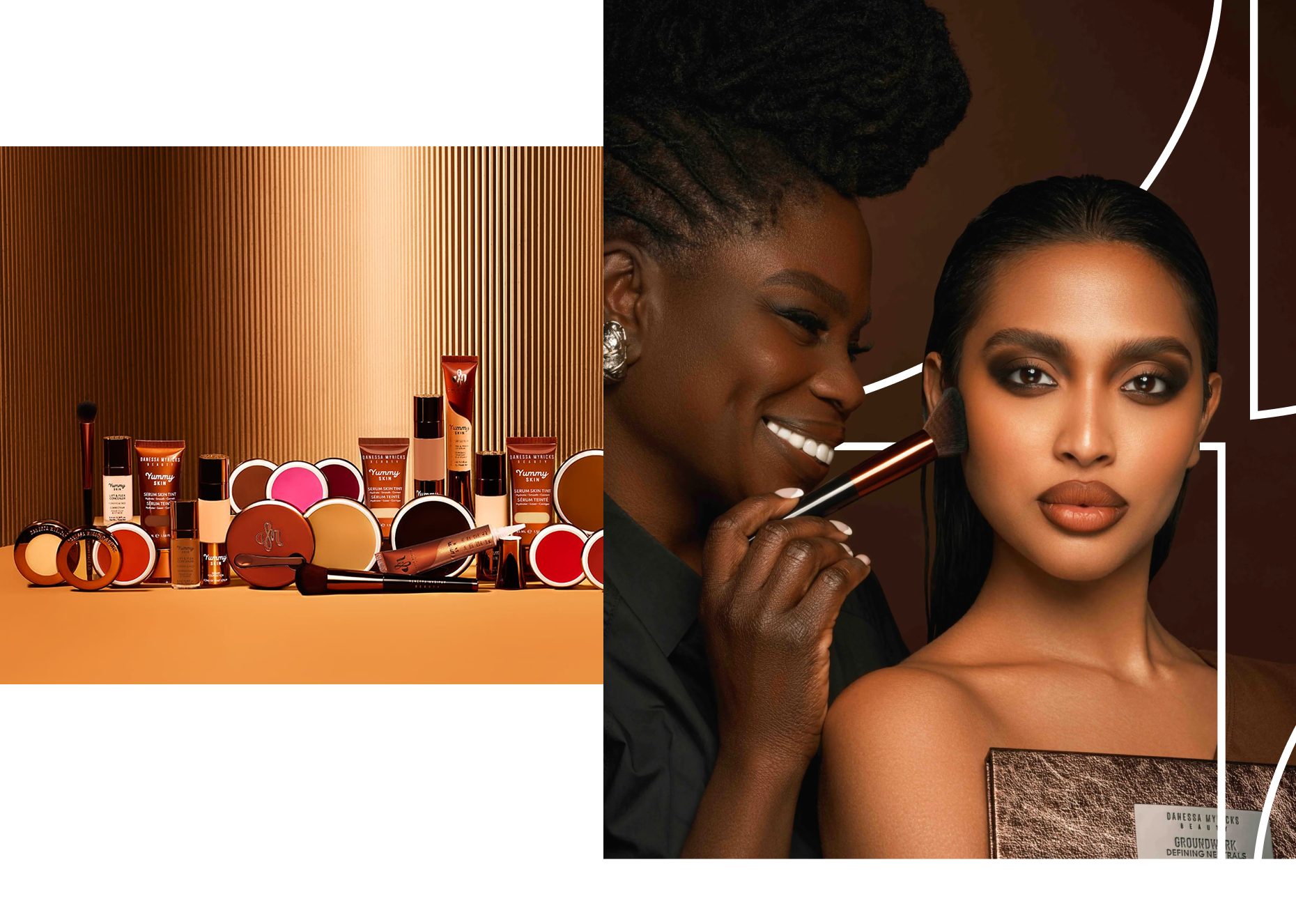

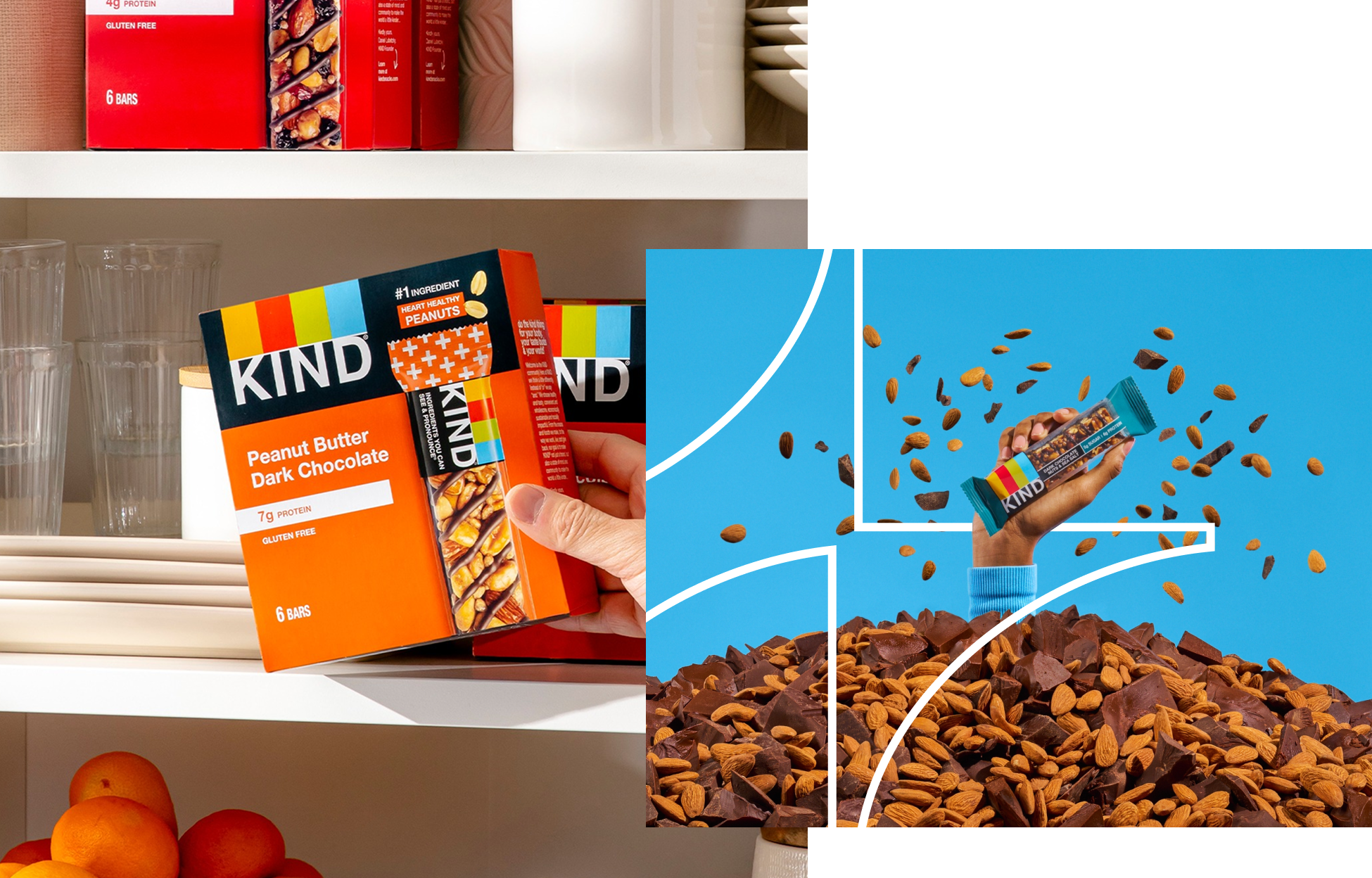

VMg consumer

Leading brands shaping consumer culture.

For over 20 years, we’ve helped founders build powerhouse brands that scale with purpose and stand the test of time.

.png)

We focus on branded consumer products and services, investing in majority and minority positions.

$10M+

$10-$200M

Growth

What Velocity Made Good1 means for you.

1 Velocity Made Good

VMG was built on the idea that better ideas and newer, bolder solutions win over time.

For over two decades, we’ve guided visionary companies through shifting markets with one clear goal: turning them into powerhouse brands that people use, trust, and interact with every day.

We surround our entrepreneurs with the talent, resources, and support to realize their boldest aspirations.

For over two decades, we’ve guided visionary companies through shifting markets with one clear goal: turning them into powerhouse brands that people use, trust, and interact with every day.

We surround our entrepreneurs with the talent, resources, and support to realize their boldest aspirations.

A partnership for the whole journey — the wins, the setbacks, and everything in-between.

VELOCITY

Sales and marketing expertise powered by bespoke consumer research and a tailored roadmap of marketing tools.

MADE

Skilled operators and advanced tools delivering the operational rigor to uncover margin and scale mid-ascent.

GOOD

A seasoned investment team with a 20+ year track record of guiding founders to standout outcomes, alongside a community of founders who’ve done it before.

Acquired by leading

global buyers.